Healthcare Overhaul: More of a struggle for some small businesses

As the cost of health care continues to soar, small business owners are especially feeling the impact of a recovering economy as they struggle to provide health care coverage for their employees.

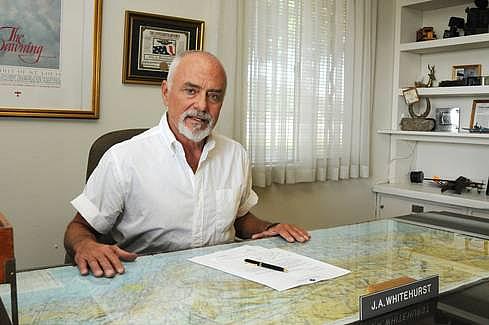

Joel Whitehurst, owner of Whitehurst Funeral Chapel in Los Banos, is concerned about health care coverage and how it pertains to the small business owner.

Like many other small business owners, Joel Whitehurst, one of three owners and manager of Whitehurst Funeral Home in Los Banos, has struggled to stay afloat during the Great Recession.

And the year-old Patient Protection and Affordable Care Act -- known as "Obamacare" -- hasn't thrown him a life vest.

Whitehurst's business, which was opened in 1921 by his grandfather, employs 13. Eleven of them are full time.

Whitehurst doesn't see much profit after paying bills, salaries and health care costs for his employees. He provides health care coverage for nine of his employees. Of those nine, six include families on their insurance.

"Most of our employees have been with us for years and years," he said. "I try to take care of them as much as I can. These people work hard. We have a team, and I want this team to stick together. I want to provide as much as I can."

But sometimes, with health care costs soaring, it's just not possible to provide as much as he wants.

In fact, his employees' medical coverage is "marginal" and the dental coverage had to be dropped, he said. "It makes me sad to see what's happening," he said. "We are just doing our best to keep our head above the water."

The provisions in the federal health care law that are designed to help small businesses like Whitehurst's haven't done anything useful for his business, he said. The amount of the tax credit he got to help pay for his employees' health care benefits was laughably small, he said.

Whitehurst hasn't seen any of what the feds claim the law is providing for small businesses. "The minute the government got involved, it got screwed up," he said of health care. "Things were pretty good before they tried to help us."

Before the Affordable Care Act became law, about 50 percent of Whitehurst's employees were covered under the Health Maintenance Organization plan; the other half were under the Preferred Provider Organization plan. When the new law went into effect, everyone had to switch to PPO.

Whitehurst couldn't afford the HMO because of increased premiums.

He said the coverage that his employees have now isn't comparable to what they had before.

Whitehurst applied for the federal law's tax credit to help pay for the health care costs of his employees, which amounts to about $64,800 a year.

He got $540.

"It's like a slap in the face," he said. "We got nothing; that's one-tenth of one month's premium."

He wonders if he were to stop providing insurance for his workers if they would be better off on Medi-Cal. "If it would be to their advantage, I wouldn't mind," he said.

Whitehurst conceded that the kind of insurance he's able to afford for his employees isn't the best, and some of his workers are struggling with high deductibles. "I'm paying for insurance so my employees can go bankrupt?" he asked.

Deductible, hospital bill 'devastating'

Salvador Contreras, who's worked for the Whitehurst family for 32 years and at the Los Banos funeral home for 18, said his deductible is $6,000 a year. His wife, Teresa, who is insured under his work plan, suffered a stroke more than a year ago and has been back to the emergency room since then.

Contreras had a bill of $12,000, and the insurance covered half of that. "It's devastating, regarding all the bills from the hospital," he said. "Hopefully, if she doesn't get sick again, I might be able to catch up."

If he can't keep up with the deductible and payments on the hospital bills, he said he would consider dropping his spouse from his insurance and see if she qualifies for Medi-Cal or disability. "I'm always working. I don't depend on any agencies, but right now I don't have any choices," he said.

Contreras, like Whitehurst, agrees that the law isn't helping small businesses with their health care predicaments.

"It doesn't help the small guy," he said. "When you have a guy who is trying to survive and he can't provide to all his employees, it's not working."

Whitehurst is glad just to still be in business. "We are breaking even, and I think that in this market, that's success," he said.

Whitehurst is far from alone is his disdain for the federal health care law.

David Spaur, president and chief executive officer of the Merced County Economic Development Corp., said he hears mostly complaints from business owners about the law. He said some believe it's one more example of government overreach and overregulation. "I don't know if it's going to benefit them or hurt them more," he said.

In 2009, in a speech to a joint session of Congress, President Barack Obama lobbied for his health care plan: "What this plan will do is make the insurance you have work better for you. ... Now, that's what Americans who have health insurance can expect from this plan -- more security and more stability."

Tell that to Joel Whitehurst. He's not buying it. And neither is Salvador Contreras.

Reporter Yesenia Amaro can be reached at (209) 388-6507 or yamaro@mercedsunstar.com.