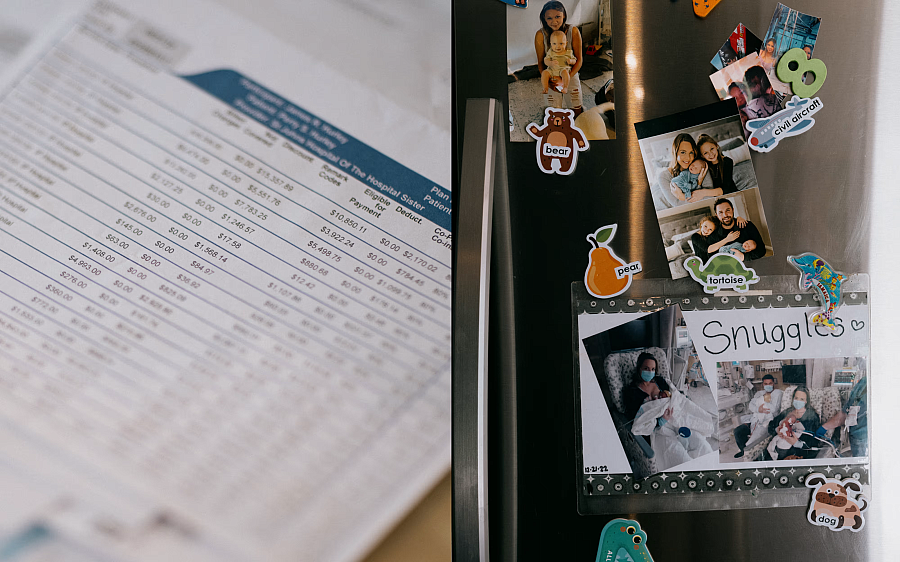

Becky Munge in the hospital two days after giving birth to her daughter Jovie.

Jovie was in the NICU, but doctors allowed her to see her mother.

“They wanted her to at least be able to do skin-to-skin if I were to pass away,” Becky said.

Becky recovered, and she and Jovie were discharged within a day of each other. But while she was in the hospital, Becky contracted a bone infection that would ultimately require nine arm operations and had to relearn to walk after developing severe weakness in her legs.

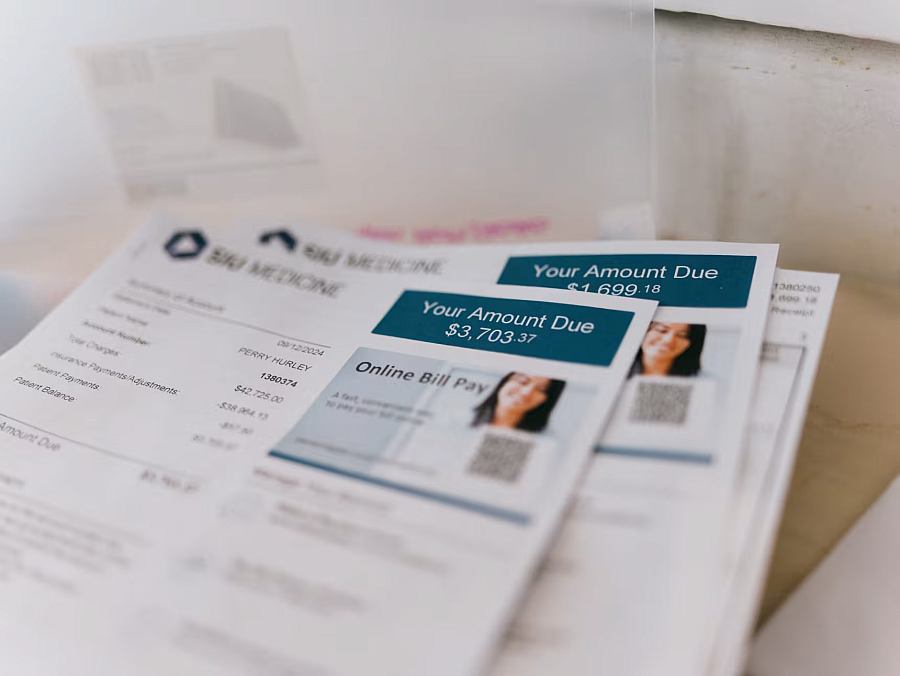

The Munges pay $1,300-per-month premiums for an insurance plan with a $3,000 in-network deductible and a $12,500 out-of-pocket maximum.

For the complicated delivery and Jovie’s NICU stay, they wound up paying the hospital $8,000, after insurance covered around $1 million in medical expenses.

Separately, Becky received treatment for her bone infection and a knee surgery at the Mayo Clinic in Rochester, Minnesota. They still face nearly $4,000 in debt for the knee surgery after having paid around $1,000 for various services so far.

The Mayo Clinic said it doesn’t have authority over insurance coverage decisions. In a statement, Blue Cross and Blue Shield of Illinois, the couple’s insurance provider, said, “we work directly with members and don’t comment publicly about their cases.”

Becky Munge holds Jovie in the hospital.

In prioritizing their medical expenses over other costs, the Munges have amassed around $55,000 in credit card debt and drained their retirement accounts.

“If we cannot control the debt, as of right now, we’re going to have to file bankruptcy,” Becky said. “That’s a huge threat over our shoulders.”

Like the Hurleys, the Munges are solidly middle-class. Cole is a self-employed insurance agent. Before her health issues prevented her from working, Becky was an orthodontic assistant. The family lives in a three-bedroom, ranch-style home.

“We’re not in poverty, but we’re not rich by any means, and we’re still struggling,” Becky said. “I wish I’d make less money so that I can get more benefits, because I’m actually more in debt now.”

The challenge of a high deductible

Of all the reasons a family can face medical debt from childbirth, high deductibles are among the most common.

“Many workers used to have zero-deductible health care plans, but that’s less true today. The majority of employer-provided private health insurance plans do have a general deductible,” said Dr. Adam Gaffney, a critical care physician at the Cambridge Health Alliance in Massachusetts who researches medical debt. In the early 1980s, his research shows, just 30% of private insurance plans had deductibles for hospital stays.

Wesley Bruce and Ashley Perez’s insurance plan had a $7,000 deductible and a $13,000 out-of-pocket limit when she got pregnant. They knew childbirth would be expensive, so they set aside money in a health savings account.

But they couldn’t anticipate how complicated their medical needs would be. Their twin girls, Isla and Juno, were born prematurely in June, each with a hole in her heart, and spent roughly a month in the NICU. The couple's insurance didn’t cover some specialty care during Perez's pregnancy, and they wound up on the hook for more than $10,000 in total.

Wesley Bruce and Ashley Perez hold their twins.

Bruce, a mental health counselor, and Perez, a Ph.D. candidate in clinical psychology, are still paying off student loans.

“I just kind of said: ‘What can we do? We don’t have a choice,’” Perez said. “I’m never going to pay off all of our debt, so add on the hospital debt to it. I don’t even know, just pile it on.”

The couple drained their health savings account and solicited donations from family members to pay their medical expenses.

But then in September, a stroke of luck: Perez qualified for financial aid from the hospital system, Sanford Health, and their balance dropped to zero. NBC News reached out to Sanford Health this month, and the couple was subsequently refunded around $7,000 that they'd already paid.

“We are committed to ensuring patients receive high-quality care regardless of their ability to pay and providing financial assistance to those who need it most,” Nick Olson, Sanford Health’s chief financial officer, said in a statement.

Nonprofit hospitals like the ones operated by Sanford Health are required by law to provide “charity care” in the form of discounted or waived costs. Eligibility varies by hospital, but many mandate that patients have incomes at or below 400% of the poverty level. Since some of those patients are on Medicaid, it’s unclear how many people benefit from the policies.

Becker referred to the system as the “Wild West.”

Instituting a federal requirement for hospitals to provide a minimum threshold of financial assistance could make childbirth more affordable, she said. Another policy on her wish list: requiring employers to offer insurance plans with varying coverage based on people’s incomes.

“Fundamentally, we could fix this problem if we as a society decided that this was a problem that we wanted to fix,” she said.

But other changes, like getting rid of deductibles altogether or even instituting universal health care, feel impractical, if not impossible. And any changes would come too late for families already overwhelmed with debt.