Barriers to Home Ownership for Latinos in California Have Long Lasting Effects on Health and Well-Being

The story was co-published with Univision Los Angeles as part of the 2024 Ethnic Media Collaborative, Healing California.

Owning a home in California is a dream for many young Latinos

Yarel Ramos, Univision Los Angeles

ANCHOR INTRO: In recent years, home prices in the United States have increased significantly. As a result, many young Latinos are finding it increasingly difficult to achieve the long-held American dream of owning their own home.

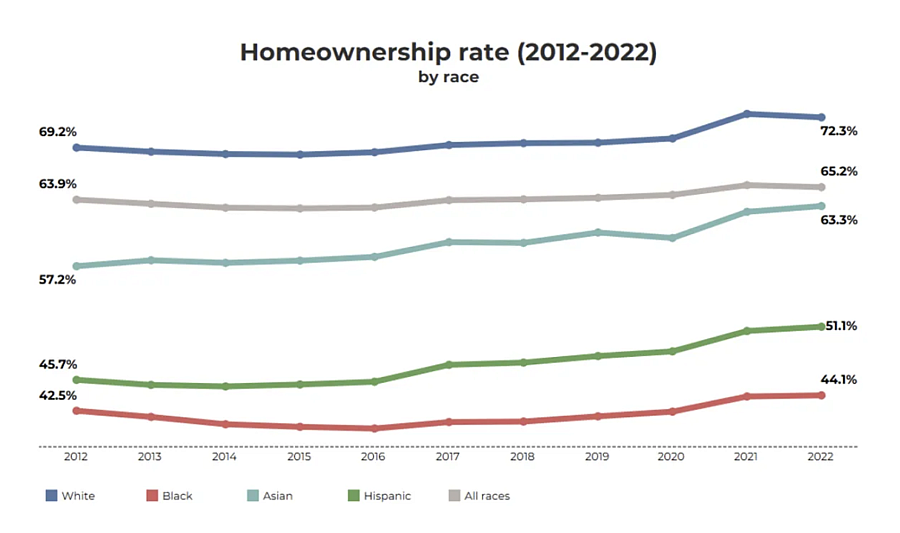

The statistics are clear: Latinos have lower home ownership rates than most other groups in California. Less than one in 10 Black and Hispanic/Latino California households could afford the same median-priced home, while 21 percent of whites and 28 percent of Asians could buy a median-priced home, according to the 2023 Association of Realtors report.

In 2022, the national Hispanic home ownership rate reached 51.1 percent, but there's still a long way to go to catch up with most other groups.

The home ownership rate in the US shows that while the rate has increased for Latinos, it still falls below most other groups

National Association of Realtors

STAND UP: The reason? A combination of factors: lower incomes, lack of access to affordable credit, the constant rise in housing prices, discrimination in the mortgage lending process and higher interest rates.

Additionally, according to NAHREP--National Association of Hispanic Real Estate Professionals--Latinos, being younger on average, are also more likely to be first-time home buyers. But the supply of affordable homes for these buyers has steadily decreased in the state.

STAND UP: We wanted to delve into this dynamic and reveal unveil, beyond the challenges these young people face, how the unattainable dream of owning a home impacts their health and future.

In collaboration with the nonprofit organization Brown Issues, we conducted a series of surveys on social media. More than 5,000 people participated in our poll.

Prior to the November elections, the main concern for young Latinos is undoubtedly housing with 54% of respondents selected a lack of affordable housing as a top concern.

When we asked why it is becoming increasingly difficult for young Latinos to own a home in California, this is what they answered:

Affordability

Income Disparities

Limited Access to Credit:

Lack of Affordable Housing Options

Gentrification and Displacement

We organized a virtual forum, where young Latinos and community leaders shared their stories and experiences.

SOT ELENA: "I have two children. They have been asking me for a real house for a long time. Because we live in an apartment. They dream of a yard. It feels like something impossible."

Elena Smith, a first-generation Mexican American, professional, and mother of two. She longs to own a home for her little ones.

Univision Los Angeles

We met Elena Smith, a first-generation Mexican American, professional, and mother of two. She longs to ownbuild a home for her little ones.

SOT ELENA: "There are many factors that make it feel like an unattainable dream."

Stand Up/Explainer:

Let's start with income and cost:

In California, the median household income in 2020 was $78,672, but Latino households were at only $62,300. This gap has increased in the last few years. Meanwhile, the median price of homes in the state is $900,000.

SOT Elena: "We can't save money. What a mortgage costs right now is too much."

The income disparity intensifies the challenges for Latino buyers, who often live in high-cost markets.

SOT Eunisses: "The paychecks are not rising as much as housing prices are. And this makes the opportunity to own a home more distant for our communities."

Los Angeles City Council District 1 Councilwoman Eunisses Hernández has experienced this dynamic.

SOT Yarel: "Tell us, councilwoman, about what you've experienced with your family ... and what members of your district tell you."

SOT Eunisses: "For me, it was impossible to buy a house. I still live with my mom and my brother. We don't have the resources to buy a house."

Los Angeles City Council District 1 Councilwoman Eunisses Hernández says it was impossible to buy a house and lives with her mom and brother.

Univision Los Angeles

According to the Hispanic Wealth Project, more than one in three Latino renters reported not having enough savings for a down payment on a home, being their main reason for not entering the real estate market. This is the challenge faced by organizations like NACA (The Neighborhood Assistance Corporation of America). Diego Duque, director of the purchasing program, explains.

SOT Diego: "There is the amount of having large amounts of cash ... but the mortgage process is complex, especially when it's the first time you're doing it, and that combined with the market as difficult as it is in California creates many barriers for young people and minorities in general."

Stand Up: Discrimination in the mortgage lending process and limited access to credit further hinder the possibility of securing a loan for the purchase of a home. These financial and structural challenges restrict Latinos’ housing options to less affluent neighborhoods with fewer resources.

SOT Eunisses: "The median age of Latino people in California is 29 years... which is the optimal age to own a home. But we encounter many barriers. Including having to pay these school loans. But there are also not enough homes to buy."

Stand Up: Data from the Home Mortgage Disclosure Act (HMDA) of 2021 reveals that Latino applicants faced a mortgage denial rate of approximately 14%, compared to 8% for white applicants.

SOT ANA: "This is very worrying. This situation not only impacts their future but affects their health, taking on more responsibility... to deal with the financial stress of their parents burdens you with an emotional weight."

The consequences of not being able to buy a home extend beyond finances... all this leaves a mark on health and well-being over the years. As Dr. Ana Segoviano, a teacher in Sacramento and advisor to Brown Issues, told us.

SOT ANA: "The housing crisis is affecting our community today... It's a present problem, but we're creating a problematic scenario for future generations."

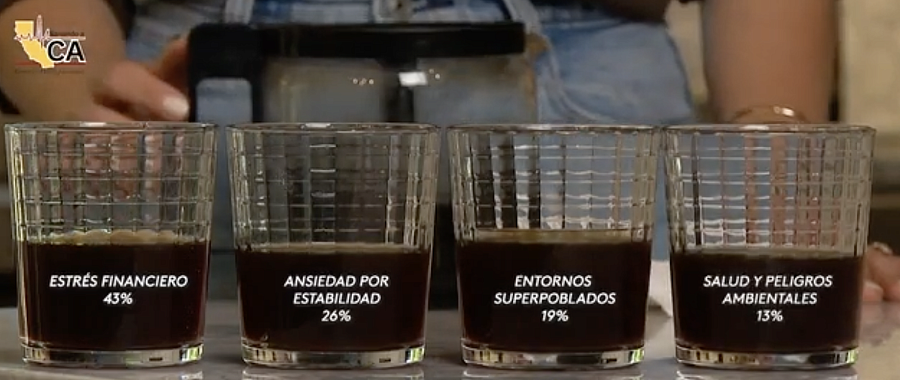

In the last of the questions we asked on social media on stressors on health, financial stress and not being able to own a home were mentioned most often.

In a poll conducted on social media, the impact on health of not being able to buy a home was identified as financial stress, anxiety about housing stability, unstable conditions and overcrowded environments, physical and health problems and environmental hazards.

Yarel Ramos, Univision Los Angeles

SOT Ana: "Financial stress was the most mentioned problem. Followed by safety for housing stability."

SOT Eunisses: "More crowded neighborhoods. We have five families living in a one-room bedroom. Being so close together causes a lot of stress and can lead to violence."

SOT Elena: "It's very stressful for me... I feel isolated, I have no one to talk to about these things."

SOT Eunisses: "First generation... they are trying to catch up with other communities that have had many generations of cultivating inter generational wealth, money that passes from generation to generation."

Stand Up: Housing instability and overcrowded living conditions can generate high levels of stress and anxiety. This chronic stress can lead to physical and mental health problems, such as cardiovascular diseases, depression, and anxiety. The lack of a home also limits long-term family stability and growth opportunities, affecting the overall well-being and future prospects of young Latinos.

SOT Eunisses: "We see how our young people and families suffer from not having spaces or a yard to breathe... to have access to places that help with mental health."

There are numerous organizations, such as NACA, that are advocating for equity in home ownership through awareness campaigns on social media, protests, and community financial education programs. However, the road to equality is still long and challenging.

SOT Eunisses: "What I want to see us do as a city, as a state, is to do the work of forgiving these loans that people have taken out to finish their education.

The message is crucial in this election year.

SOT Diego: "The important thing is for the youth in our communities to realize that they have power through voting. Participating in the political arena and using the united vote of all to elect people who represent us and make changes in the housing dilemma."

SOT Eunisses: "Here in the city... I think we should build more homes. Especially affordable homes. That we allocate more resources for first-time home buyers."

Young Latinos in California find themselves in the midst of an unrelenting storm of challenges when seeking to acquire a home. From affordability and limited access to credit, to the scarcity of affordable homes and discrimination, young Latinos in California face a daunting set of challenges. These barriers not only make it harder to own a home but also cast shadows over their well-being and future aspirations.

In California, there are programs and options designed to help young Latinos and other first-time homebuyers. Such as:

California Housing Finance Agency (CalHFA) - They offer fixed-rate mortgages for first-time homebuyers.

My Home Assistance Program: Aids with down payment and closing costs.

Teacher and School Employee Assistance Program: Offers assistance for down payment to teachers and school employees.

Federal Housing Administration (FHA) Loans

Latino Economic Development Center (LEDC)

Local programs and grants such as the Los Angeles County First Mortgage Program and the Mayor's Office of Housing and Community Development programs in San Francisco.

These programs, along with education and counseling, aim to reduce barriers to home ownership and support young Latinos in achieving the dream of owning their own home.

This project is supported by the USC Annenberg Center for Health Journalism, and is part of “Healing California,” a yearlong reporting Ethnic Media Collaborative venture with print, online and broadcast outlets across California.